Bybit Exchange, one of the most famous platforms to trade Bitcoin and Ethereum on the spot market but as well with leverage. In this article you will read everything you need to know on how to trade Bitcoin on the Bybit Exchange.

To trade on Bybit you first would need to create an account. To sign up you only need an e-mail and a password.

First of all, why do traders prefer to use the Bybit exchange ? Well, to answer this question we need to look at what’s the most important thing that an exchange needs to offer to its traders ? Liquidity! Liquidity is the most important factor of an exchange, because if there is no or low liquidity to fill the trades, the traders are going to have a bad experience. As of now Bybit is one of the exchanges with the highest amounts of liquidity which makes it so popular for traders to trade Bitcoin.

Deposit Bitcoin

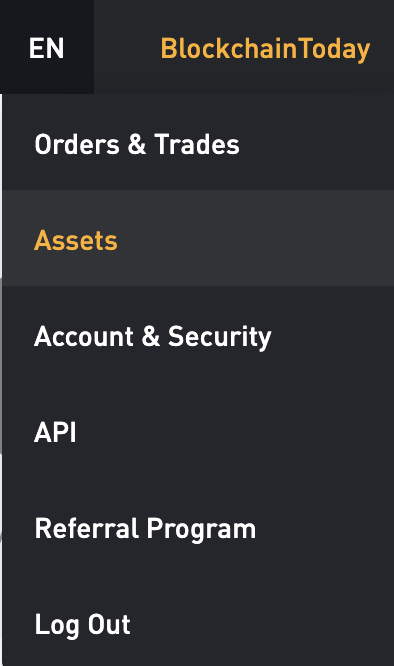

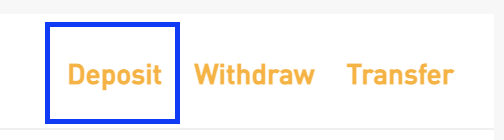

Once you’ve created an account you can deposit Bitcoin or any other cryptocurrency that Bybit is offering into your account. To deposit you will need to go to Account -> Assets -> Deposit

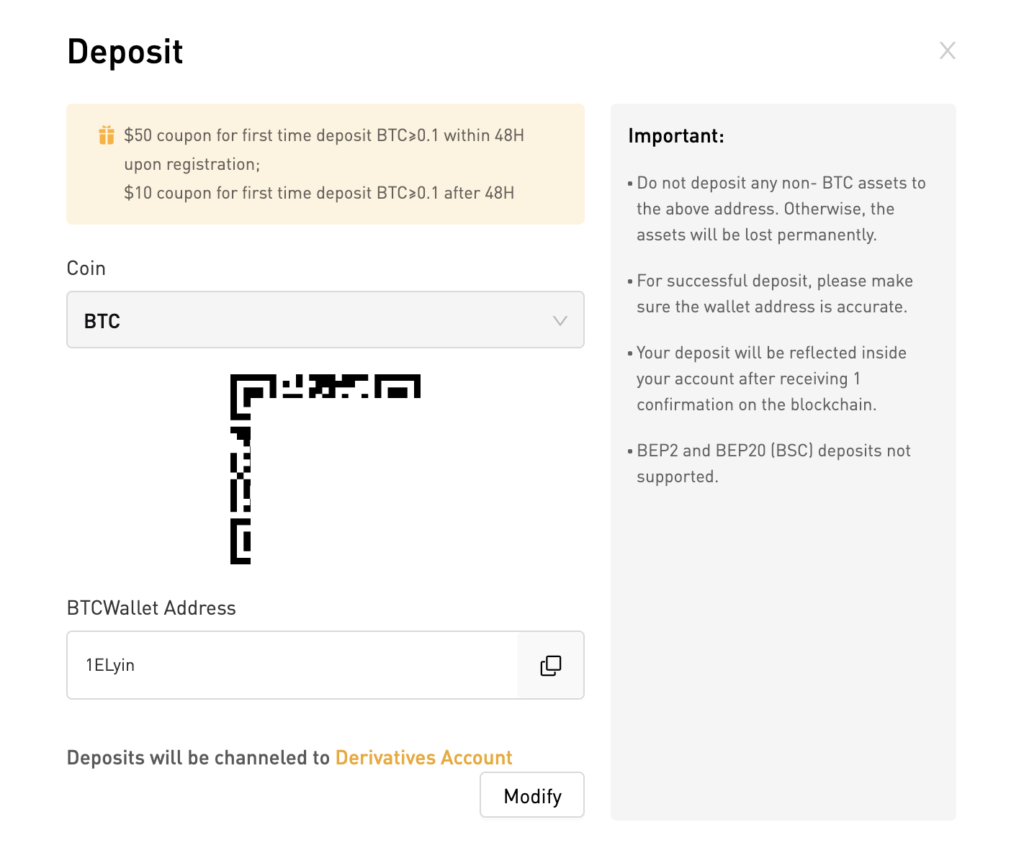

Once you’ve clicked on “Deposit” you will see the Bitcoin address where you can send your Bitcoin (BTC) to. You can either use the Bitcoin address presented on the bottom or use the QR-code that Bybit is showing.

Important to make sure that you only send Bitcoin to a Bitcoin address. All deposits on your Bybit account will be channeled to your derivatives account.

The Cryptocurrencies that you can deposit on Bybit are:

– Bitcoin (BTC)

– Ethereum (ETH)

– Ripple (XRP)

– EOS (EOS)

– USDT (Tether)

Bybit Markets

Bybit is offering two types markets where you can trade in :

– Spot Market

– Derivatives Market

Spot market

The spot market is where Bitcoin and other cryptocurrencies are traded for immediate delivery. That means that you can directly buy or sell Bitcoin for USDT. If you buy Bitcoin on an exchange and receive it directly, you’ve bought in on the spot market.

Futures market

Futures are derivative contracts, on the other hand, is based on the delivery of the underlying asset at a future date. This makes it possible for traders to speculate on Bitcoin using leverage. That means that the trader can borrow equity from the exchange to increase their order to be able profit more from price fluctuations. I will explain in more detail how this actually works but let’s first have a look at the contracts Bybit is offering.

Bybit Trading Contracts

To prevent any confusion on which trading pairs you can trade over on Bybit I will explain about the different contracts that Bybit is offering.

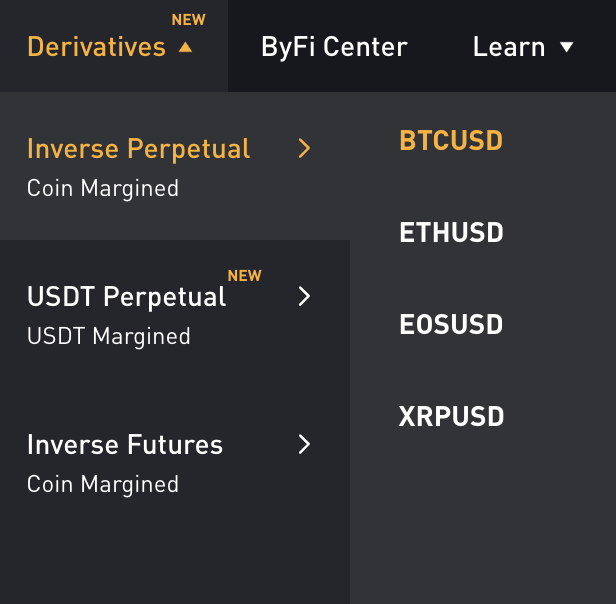

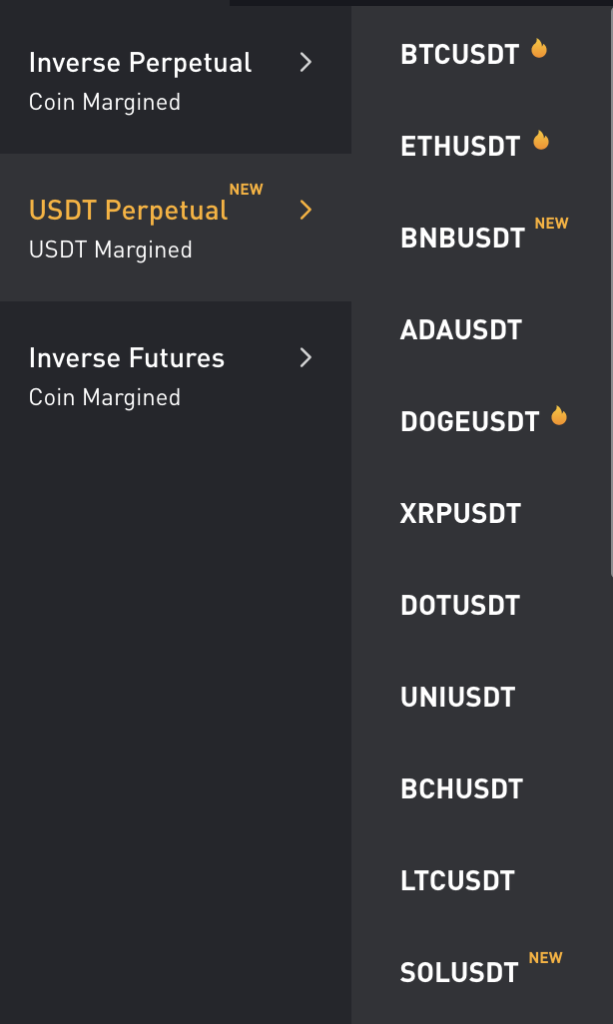

Basically Bybit is offering two main contracts :

– Inverse Perpetual contracts

– USDT Perpetual contracts

Inverse Perpetual Contracts

These contracts are settled in cryptocurrencies. Let’s say you want to trade Bitcoin, using Bitcoin then you would use an inverse perpetual contract. You can Long (buy) or Short (sell) Bitcoin using Bitcoin as collateral.

Let’s say you have 1 Bitcoin and you believe that the price of Bitcoin will increase over the next days and want to take advantage of that price swing. You can leverage that 1 Bitcoin in order to make more profit.

Bybit is offering inverse perpetual contracts settled in Bitcoin, Ethereum, XRP and EOS.

USDT Perpetual Contracts

These contracts are settled in USDT. That means that you’ll need USDT to open a position on Bitcoin or any other crypto and that the profits or losses are settled in USDT.

The interesting with the USDT settled contracts is that Bybit is offering a lot of different trading pairs to trade.

You can trade the following pairs in USDT settled contracts on Bybit :

– Bitcoin (BTC)

– Ethereum (ETH)

– Binance Token (BNB)

– Cardano (ADA)

– Dogecoin (DOGE)

– Ripple (XRP)

– Polkadot (DOT)

– Uniswap (UNI)

– Bitcoin Cash (BCH)

– Litecoin (LTC)

– Solana (SOL)

– Chainlink (LINK)

– Polygon (MATIC)

– Ethereum Classic (ETC)

– Filecoin (FIL)

– EOS (EOS)

– Aave (AAVE)

– Tezos (XTZ)

– Sushiswap (SUSHI)

– Nem (XEM)

The Bybit Interface

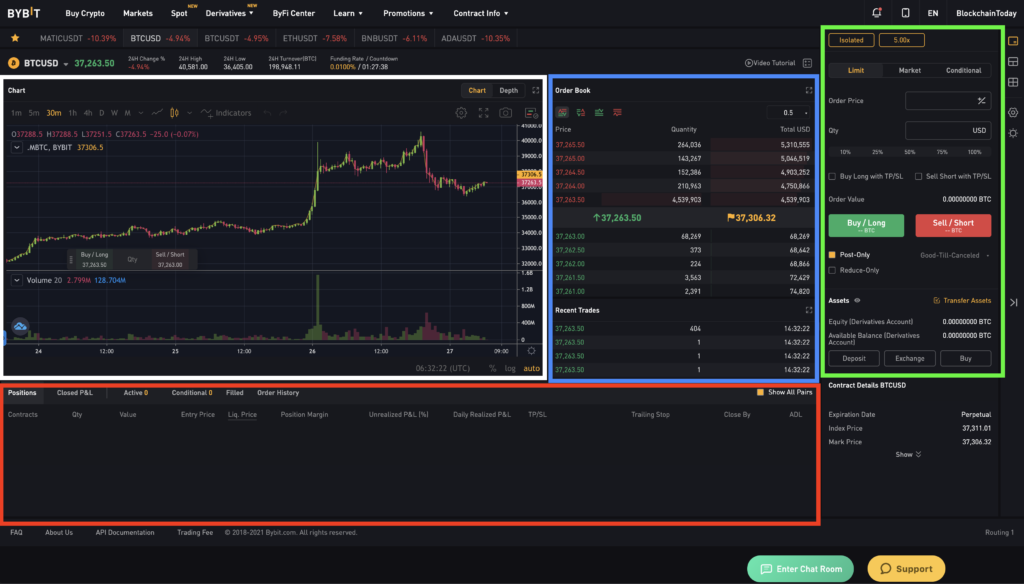

So although the contracts are slightly different, we are going to have a look at the inverse perpetual contract. Let’s have a look at the interface.

In the picture above you can see I’ve divided the interface of Bybit into 4 sections :

White Square

This is the chart of the asset that you’re trading, in this case Bitcoin. You can use this chart to analysis and even see you entries and exits once they are placed.

Blue Square

This is the order book, here you will find all the buy and sell orders that are being placed in the order book with in the middle the actual Bitcoin price.

Green Square

This is the place where you can open an order on Bitcoin. There are different order types where we will go into further down this tutorial.

Red Square

In the red square you can see all your open position and active orders.

Leverage trading

Also known as margin trading, leverage trading refers to the use of borrowed capital to get a higher potential return on your investment. This allows you to open positions that are larger than what your initial capital would otherwise allow.

Let’s say you have 1 Bitcoin and open a long (BUY) position on Bitcoin with a 10x leverage. That means that you can buy 10 Bitcoins on contract with that 1 Bitcoin. If the price of Bitcoin increase by 1%, you will make a 10% profit. However the opposite is true as well, if a trade goes against you, you will lose more as well. The risk is higher but there is a higher potential reward too.

People often ask if you can lose more money than your initial investment and that NOT the case. If your trade loses the initial investment you will be automatically stopped out of that trade which means that you can lose your initial investment but not more then you’ve put into that trade. That why trading with leverage comes with a liquidation price.

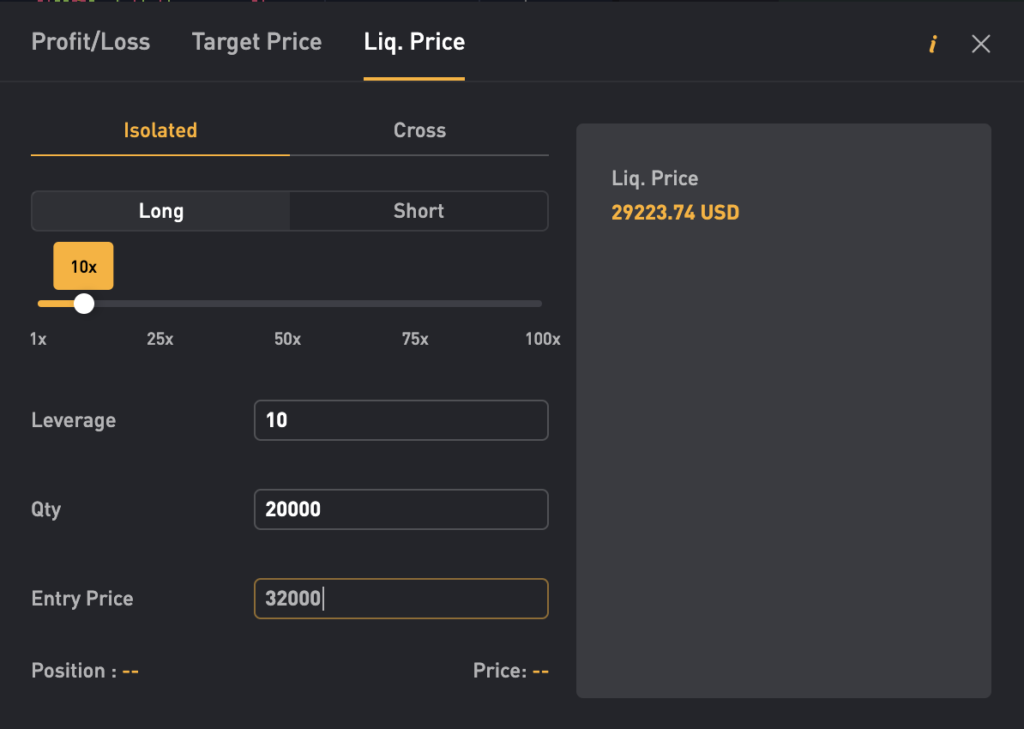

Bybit Calculator

Above the blue box there is a small button which brings you to the Bybit calculator which is a great functionality on their platform to calculate your profit/loss but as well you liquidation price. Let’s have a look at an example to explain what a liquidation price is.

So let’s say you open a long position which basically means that you speculate on the price of Bitcoin to go up. Your entry price is $32.000 and you’ve bought $20.000 worth of Bitcoin and you’ve used a leverage of 10x.

Now when the price of Bitcoin moves 1% up, you will gain 10%. If the price of Bitcoin goes 1% down, you will lose 10%. This is the power of leverage trading. If the price of Bitcoin went down with 10%, that means that you lost your initial investment and therefor the exchange uses a safety mechanism to ensure not more money is being lost, so the position will be closed automatically and the exchange will be paid back the amount that has been borrowed.

Order Types

There are 3 different order types :

– Limit Order

– Market Order

– Conditional Order

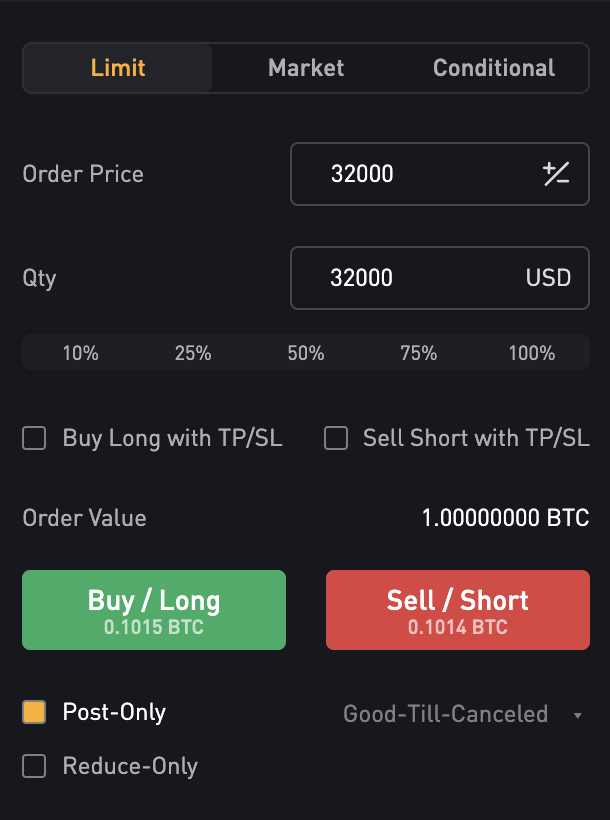

Limit Order

A limit order is an order that will be executed once the asset, in this case Bitcoin reaches the limit price. Simple example, you set the limit price at $32.000 and want to buy 1 Bitcoin.But the price of Bitcoin right now is $32.850. You order will be placed in the order book and once the price of Bitcoin reaches $32.000, your order will be filled.

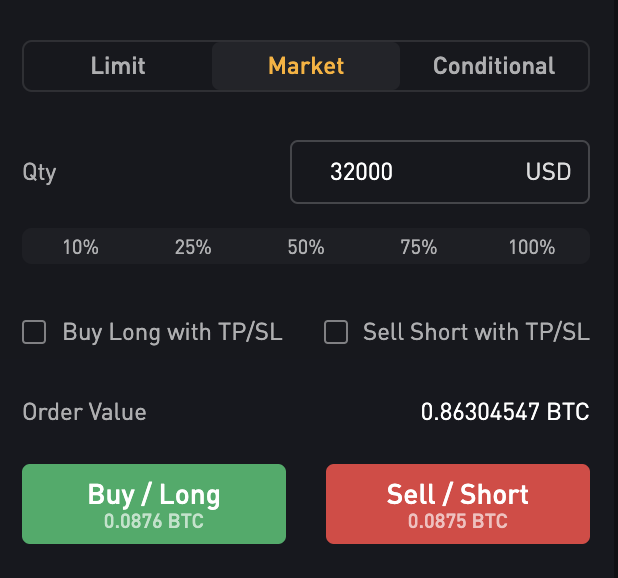

So the order price is the price you want to pay for Bitcoin, in this case $32.000 and the Qty (Quantity) is the amount of Bitcoin you want to buy or sell, in this case that is also $32.000.

Below you can see two buttons, a green one with BUY (Long) and a red one with SELL (Short). This is to determine the direction you want to speculate on. If you are speculating that the price of Bitcoin will increase you will buy Bitcoin which is also known as opening a long position. If you think that the price of Bitcoin will decrease then you can sell Bitcoin, also known as shorting.

Market Order

A market order works differently because a market order is an order that will be executed immediately at the best available market price. Most traders are using this order type to open a position immediately when Bitcoin is breaking out for example.

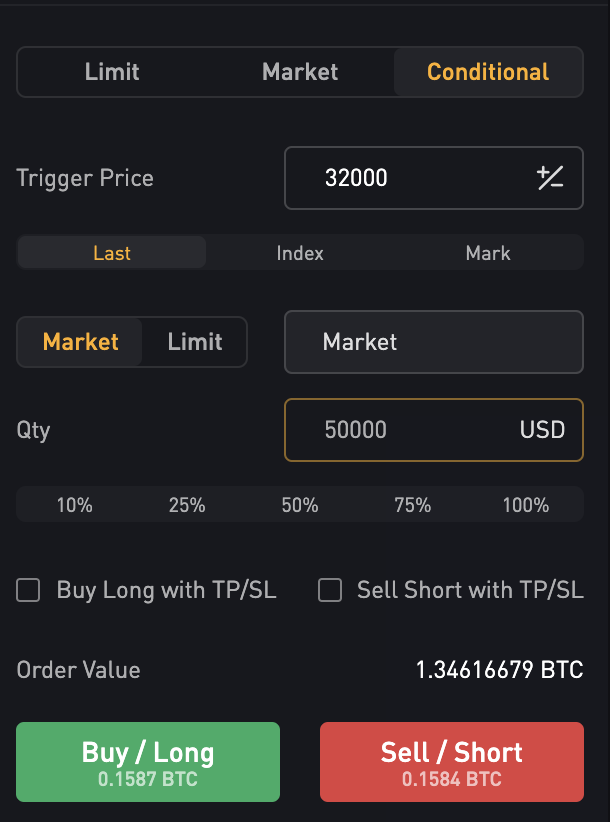

Conditional Order

A conditional order is an order that will be executed once a specific “trigger price” is met. Let’s have a look at an example.

Let’s say that we think Bitcoin is trading at $31.000 and will see an increase after touching $32.000. Then we could set a conditional order like in the image above. Once the price of Bitcoin is hitting our “trigger price” of $32.000 then we will execute a “Market buy order” with a quantity of $50.000. So this order will only be executed once Bitcoin met the trigger price.

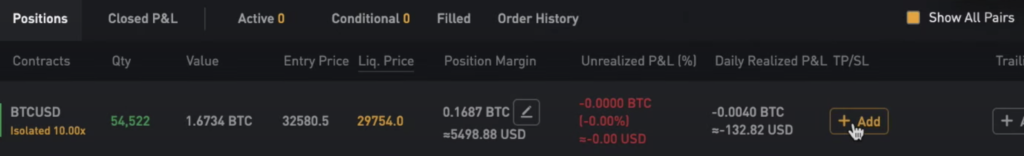

Take profit & Stop loss

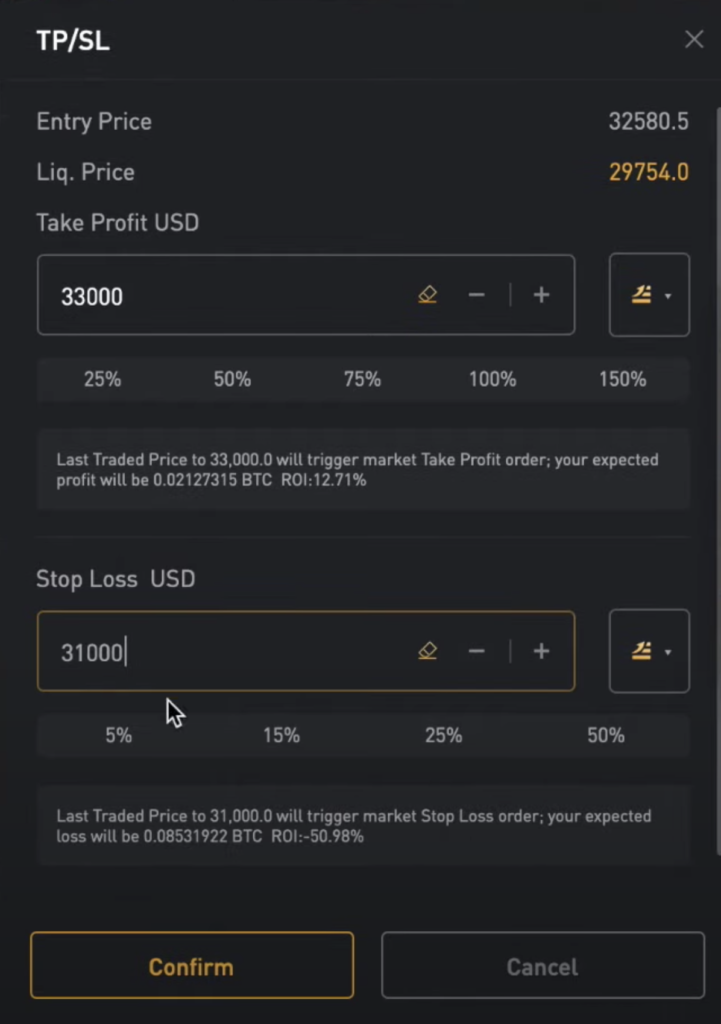

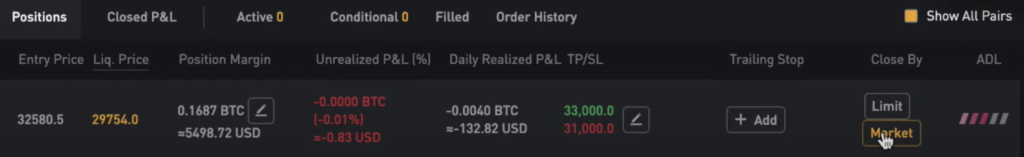

Once your position is opened you can see your open positions in the red square. Here you can also set a take profit and stop loss (TP/SL).

A take profit is a setting that you can set in order to automatically take profit when your trades hits a certain target.

A stop loss is a setting that you can set in order to automatically stop a trade after a certain amount of losses.

So in the example above, if Bitcoin reaches the level of $33.000 then will take profit and close this trade with an estimated profit of 12.71%. We have set a stop loss at $31.000 which means that when Bitcoin reached $31.000 our trade will be stopped out with an estimated loss of 50.98%. These numbers are for example purposes.

Closing a Trade

You can close a trade with a limit and market order. These are working similar as with opening a trade.

If you want to close your trade with a limit order you can set the limit price at which you want the trade to close. You also can set the amount of the trade you want to close. So let’s say we opened a long position on Bitcoin at $32.580 we could set our limit order at $33.000. The trade will be closed when Bitcoin reached that level with a limit order.

If you want to close your trade immediately, you can do so with a market order. A market order will close your trade directly at the best available market price.

Bybit Bonus

Bybit is offering right now a special bonus to all the subscribers of The Blockchain Today. Join Bybit here to get a $600 bonus + 10% Discount on your fees for the first month.

Bybit Video Tutorial

Below you can watch a video tutorial on how to use Bybit. This video will explain everything you need to know in order to trade Bitcoin on the Bybit Exchange.

If you’d like to know more you can visit this detailed and complete Bybit review.