Many traders and investors are asking themselves right now, what is happening with Bitcoin ? Are we in a bear market ? Are we in for a bounce ? What can we expect ?

First of all, let me clear out that there is no clear answer to this question. We are seeing a lot of signals which shows that Bitcoin might be in for a bounce, even for a continuation of this uptrend but the price is not showing any strength, how so ? Let’s have a look at Bitcoin.

Bitcoin right now is losing the 50 Weekly moving average (+-32000) which historically has been a very significant level similar as the 20 Week ly moving average. So the price is showing a lot of weakness, we haven’t seen a bounce (yet) in the Bitcoin price either which doesn’t bring much confidence as well. How can it be that other indicators are showing opposite signs ? Let’s have a look at it!

The funding rates have been historically a very good indicator in predicting the macro-direction for Bitcoin. Let’s have a look at 2019-now. Every time we have seen a period of negative funding rates it has never been followed be a big move to the downside but always resulted in leaving the majority of the investors at the wrong side and going into the upper direction.

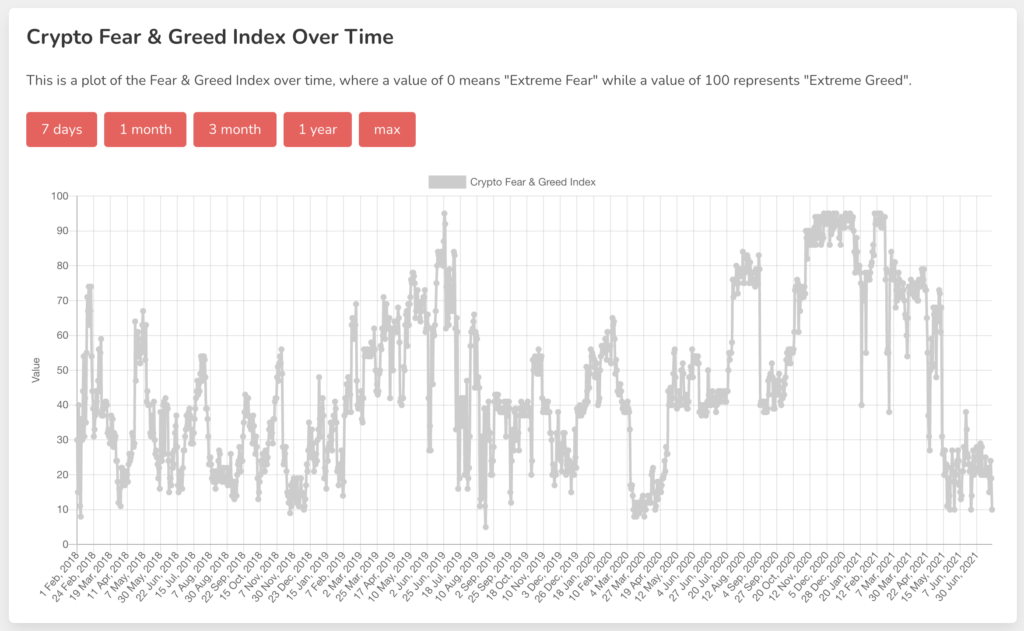

The crypto fear and greed index is showing that we are since May already in a fearful sentiment which we haven’t really seen in the past but in the majority of the times when the F&G index is at lower levels for a period of time it can signal us that we’re close to a bottom. Because the majority of the investors are most of the time at the wrong side due to the emotional side of investing and trading, the most difficult part.

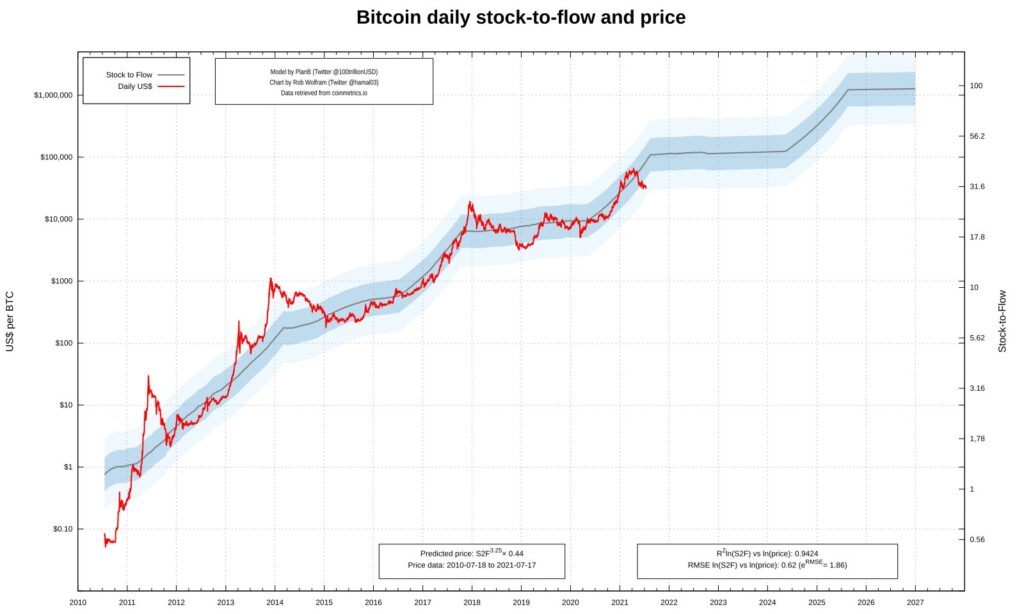

The Stock to Flow model (PlanB) has been very correct over the past 10 years when predicting the Bitcoin price. This model is on the edge of being broken if we don’t get a bounce before leaving the light-blue area.

When we have a look at the monthly returns for Bitcoin then we right now have already 3 consecutive negative months and it shows that mostly that mid-years are less interesting than the rest of the year.

Which perspective do I have on Bitcoin right now ?

I personally do think that right now we have to have a bearish expectation for Bitcoin until it shows us otherwise. A break below the 50 WMA is a bearish sign (if we close the weekly below it) and I do expect when that happens more downside for Bitcoin. However we do have to be aware of the other signals in the market which is showing us that Bitcoin could see a significant bounce from these levels too. And remember that the sentiment can change in an instant, so expect it!

Did the bull market end ?

I don’t think so. I don’t think there is enough evidence right now to suggest that we’ve ended the bull market. A lot of on-chain data is showing strength in the adoption of Bitcoin and crypto. Price models like the stock to flow and charts like the Puell multiple are still looking good for a continuation of the bull market. The regular financial markets are as well still trading above the rising channel (entering the blow off top phase).

Right now even when the price of Bitcoin looks weak, and we could see a multi-month down-trend be aware of the other signals and that Bitcoin in any instant can turn around. It’s similar in previous bull markets at the end of corrections people are losing the belief in Bitcoin, it feels like there is no potential upside anymore (capitulation) and that’s the moment that we’re actually close to a bottom.

Perspective : Bearish until Bitcoin can re-claim some levels, first one is the 50WMA.