Bitcoin’s momentum recently slowed down and we are already for a period consolidating, broadly moving sideways without a clear direction in the short term. In this moments alt-coins tend to outperform Bitcoin and that’s exactly what we’ve seen so far. A lot of alt-coin charts are looking bullish against Bitcoin (see Alts/Btc). In this update I want to discus 3 potential scenario’s for Bitcoin and it’s effect on alt-coins in the short term timeframe.

1st scenario

Bitcoin continues to move sideways without extreme volatility but remains above the 20 week Moving Average, a key support in a bull-market and a key level for the amount of “confidence” in the market. This scenario would be great for alt-coins, as Bitcoin takes a break and in a broad sense is just moving sideways without a bearish structure like trading below the 20 week MA.

2nd scenario

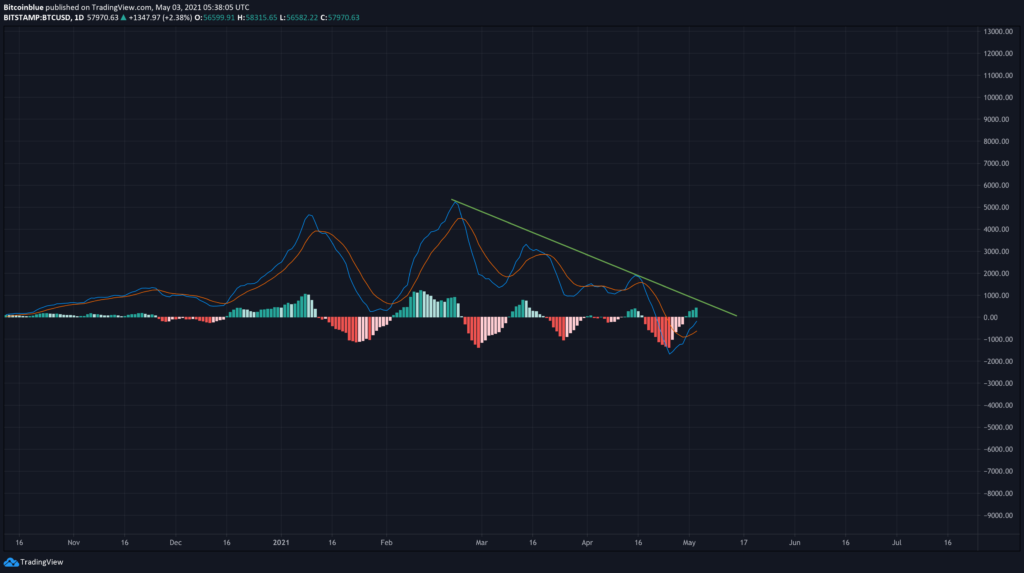

Bitcoin continues its uptrend and eventually will break above the previous all time high at 65K. If Bitcoin really wants to continue a rally with bullish momentum we need to break the declining resistance on the daily/weekly RSI and daily MACD. Only then Bitcoin can make another attempt for a rally. This scenario will be as well bullish for alt-coins and alt-coins following the direction of Bitcoin, not only in USD comparative but as well in BTC comparative. We have seen that in 2017 as well, where Bitcoin saw a rally together with alt-coins simultaneously.

3rd scenario

We are still seeing an extremely bullish sentiment around Bitcoin in general and we haven’t seen a huge capitulation where Bitcoin is really shaking out some weak hands of the market. Also when we have a look at the 20 weekly Moving Average on Bitcoin then we can see that we haven’t tested this level for over 200 days in a row right now. This is price behaviour we haven’t seen in the previous bull-market at all. Bitcoin often came back to test the 20 weekly MA, often with a big wick below which we usually call a “shakeout”. Confusing a lot of investors into a bearish scenario while we actually bottoming out. We have to be aware of this fact and that it’s actually an unhealthy signal in the shorter term timeframe showing us that we might see a shakeout before continuing this uptrend.

It’s difficult to prepare for this scenario as it often comes quickly and unexpected. However, there are some things we could do like taking extra caution when Bitcoin breaks back below key levels like the 50 Daily Moving Average and the 20 Daily Moving Average. These are the first warning signals where you could act upon (e.g. hedge into stable coins). This scenario would be very bearish for alt-coins in the short term time-frame but brings a lot of opportunities as well as asst-coins most likely will capitulate in the Bitcoin comparative. If you have your buy orders ready they can get filled.

The SP500

Something to watch is the S&P500 this year as well. We just broke out of a rising channel. The last time we’ve seen a similar market structure was at the end of the rally in 2008, right before the housing market crash. The SP500 in the last years have been highly correlated (especially short-term/directly) with the price of Bitcoin. I think this year we could see an event where if the SP500 breaks back into this rising channel which would be a bearish signal it could drag Bitcoin down with it.

Note: September this year coincides with a blog post I made earlier about a potential stock market crash this year.